How Secured Credit Cards Work: Full Guide

Table of Contents

Last Updated: May 29, 2022

Here’s a paradox for you. You want to get a credit card to build good credit, but you need good credit to get a credit card. So, how exactly are you supposed to pull this off? The best option is using a secured credit card.

What Are Secured Credit Cards?

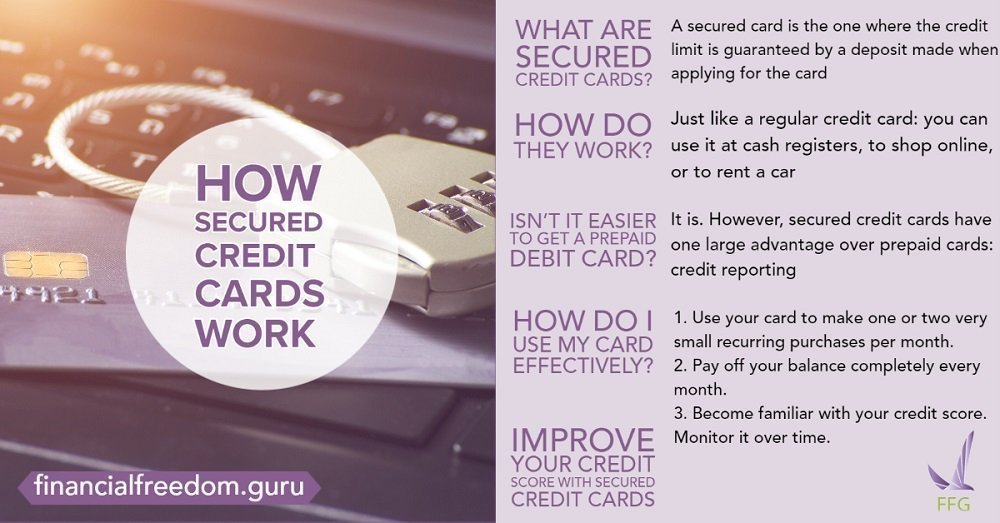

A secured card is the one where the credit limit is guaranteed by a deposit made when applying for the card. The deposit can be up to 110% of the credit limit: a $1000 limit may need an $1100 deposit. This serves to reduce your credit card risk. If you don’t pay your bill, the credit card issuer will cover your bill with your deposit. This explains why banks are willing to give secured credit cards to applicants with bad or poor credit.

Since your credit limit is a deposit, the bank will return your deposit after your account meets some criteria. Prove to your credit card company that you use the card responsibly by paying your monthly bill on time. If you can pay your bill in full every month, this would be even better. These actions will help improve your credit score to the level needed for an unsecured card. Once this criterion is met, your credit card company may convert your card to an unsecured one. At that point, they will return your deposit.

How do Secured Credit Cards Work?

Except for the deposit, a secured credit card behaves just like a regular credit card. There should be no difference between them on your credit report. (If there is, contact your credit card issuer to have this fixed.) You can use your card at cash registers, to shop online, or to rent a car. Your card issuer may charge an annual fee, but there are many zero fee options. The card issuer will report your credit card behavior to the credit reporting bureaus, building your credit history.

You should be aware that only providing a deposit does not guarantee that you will be approved for a secured card. Some cards have other requirements; for example, an applicant may need a bank account. Other cards don’t require a credit check or a bank account. We recommend you to review all account information thoroughly before selecting a card.

Isn’t It Easier to Get a Prepaid Debit Card?

Yes, it is so much easier to purchase a prepaid card at the local store and load money on it. However, secured credit cards have one large advantage over prepaid cards: credit reporting. Prepaid debit cards will not report your credit information to the credit reporting companies. Prepaid debit cards may have higher fees. Some prepaid cards have a monthly maintenance fee that eats into the debit card balance; secured cards do not. Secured cards have a lower liability if your card is used fraudulently ($50 versus $500 with a debit card).

Alright, I’m Convinced. How Do I Use My Card Effectively?

Here are a few tips for using your secured card to maximize your credit building activities.

- Use your card to make one or two very small recurring purchases per month.

- Pay off your balance completely every month.

- Become familiar with your credit score. Monitor it over time.

Improve Your Credit Score with Secured Credit Cards

Secured credit cards give you credit by taking a deposit equal to the amount of your credit limit. They give applicants with bad or poor credit an opportunity to build credit. This is an excellent way to correct financial mistakes made in your past. You should read and understand all available information related to your credit card contract, and use your credit card wisely. Make sure to pay off your card as agreed. You can apply for an unsecured card when your account is in good standing for a certain amount of time. Now that you know how secure credit cards work, you can use this valuable tool to improve your credit.