Effective Ways to Maximize Credit Card Rewards

Table of Contents

- How to Maximize My Credit Card Rewards? (7 Ways)

- #1: Pick the Right Rewards Credit Card

- #2: Decide if the Card Is Worth It

- #3: Take Advantage of the Sign-Up Bonus and Benefits

- #4: Use This (One) Card for Most of Your Spending

- #5: Pay Attention to Important Card Details and Dates

- #6: Use Your Credit Card Rewards Portal

- #7: Pay Your Balance in Full Each Month

- Take Full Advantage of Your Credit Card Rewards

Updated: December 1, 2022

Rewards credit cards can provide access to some amazing benefits. The trick is to take full advantage of your credit card without the burden of unnecessary debt. If you can maximize your credit card rewards, you’ll make the money you’ve spent on purchases work harder. This, in turn, makes your rewards stretch further.

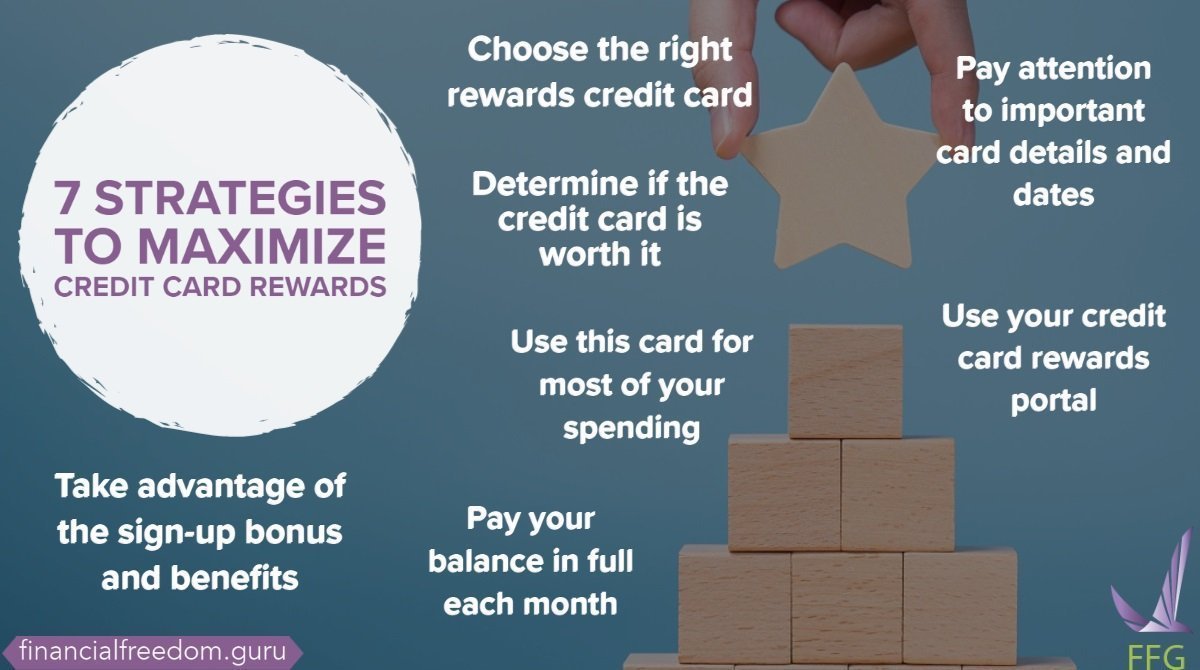

7 Strategies to Maximize Credit Card Rewards

Using the following guidelines, you should be able to get the most out of your rewards credit card.

Choose the Right Rewards Credit Card

Carefully select the rewards credit card which fits your lifestyle and planned spending habits. Your credit card rewards should reflect your interests otherwise you’ll find it hard to use them. A good method to help choose a rewards credit card involves reviewing your spending habits. You should select a card that gives rewards in the category where you spent the most money.

Determine If the Credit Card Is Worth It

A credit card’s perks are only worth it if you benefit from them. Consider how much you will spend on the card, and what you can earn with this level of spending. Calculate the effective cashback rate on your rewards card. The card may come with a high annual fee or higher-than-average interest rates. You may have to meet an introductory spending threshold to qualify for advertised benefits. Will your earned benefits at least cover the cost of your annual fee? If the answer is no, why are you paying for this card?

Take Advantage of the Sign-Up Bonus and Benefits

Look for a card with a sign-up bonus that you can earn with a responsible spending pattern. This means that you can meet the threshold through regular purchases that are paid in full every month. It may also mean a carefully planned large purchase on a 0% APR card that will be paid off. Once the bonus is processed and approved, don’t forget to use it.

Look into using the benefits that have no spending threshold. You can easily maximize your credit card rewards without having to meet a minimum dollar amount. Car rental insurance, travel insurance, and price protection on your purchases are a few examples. Rewards cards offer more exclusive benefits than their non-rewards counterparts.

Use This (One) Card for Most of Your Spending

We generally recommend having three credit cards: a primary card, a backup card, and a specialty card. Many of your everyday purchases can be made using your primary rewards credit card: groceries, gas, utilities, and eating out. Splitting your purchases between multiple cards can cut into your opportunities to earn rewards. However, you may need one more rewards card for your special purchases.

Pay Attention to Important Card Details and Dates

You should read the card agreement to understand how the benefits you earn will be managed. They may be subjected to limitations, like blackout dates and earning caps. The terms state how long rewards may be active, if and when they expire, and how to keep them active. Other cards may set maximums for earned rewards, restrict purchase categories to specific parts of the year, or charge fees. This makes it harder to earn the most rewards possible unless you are constantly monitoring the conditions for card use.

Use Your Credit Card Rewards Portal

Review this website frequently to see if there are any specials going on. In some cases, the portal may contain better point transfer ratios than other sites, allowing your benefits to go further. With other bonuses, it may be cheaper to purchase an item through the portal. Always read the fine print. Some cards may offer a worse point transfer ratio shopping through the portal or converting the points to gift cards.

Pay Your Balance in Full Each Month

The interest that accumulates from carrying debt every month is more than the cash back and rewards you’ll earn. Other ways you can lose money is by overdrawing the card or owing late fees on your payment.

Take Full Advantage of Your Rewards Credit Card

Having a rewards credit card is a great way to get some awesome benefits out of your credit card. Don’t feel guilty about using what your credit card is offering. If it’s available to you, you should take full advantage. Just remember to use our tips, and you’ll be able to maximize your credit card rewards and maintain healthy spending habits.