Ways to Monitor Your Credit Score Effectively: a Guide

Updated: December 1, 2022

Let us introduce our friend Joe. Joe thinks that just because he has good credit habits today his credit is fine. He doesn’t monitor his credit score as often as he should. Unless he’s applying for a credit card or a loan, he thinks those three digits aren’t important. Unfortunately, when his credit application is denied, he goes into a tailspin.

Don’t be like Joe. He had the best intentions, but he didn’t understand the value of monitoring his credit report regularly. He didn’t realize that his credit score is a reflection of his general financial health. If he had reviewed his report on a frequent basis, he would have caught any problems early. He could have made a plan to correct small problems before they turned into big ones.

Table of Contents

Reasons to Monitor Your Credit Score Regularly

There are a number of really good reasons for monitoring your credit score often. You may find that one, some, or all of the reasons are applicable to your situation.

- Knowing your current situation. Your credit score is a crucial indicator of your overall financial health. You should have a fairly accurate idea of your economic status at any given time.

- Maintaining (or improving) credit health. There is no quick fix for bad credit. Your credit history uses the last seven to ten years of data available. Any (positive) changes take months to be reflected on your credit report and your credit score. By regularly checking your score, you buy yourself some time to correct any problems in your credit history. This will strengthen your case when you are applying for credit in the future.

- Ensuring credit accuracy. Your credit score is a numerical interpretation of your credit report. If your score is low, it should be a sign to check the report and make sure it is accurate. Credit issuers and credit bureaus are required to investigate any claims of errors in your reported credit history. If the claim is valid, they must remove it and readjust your score.

- Greater confidence when submitting applications. If you know your score when you seek credit approval, you won’t be caught unaware by the results. You will make better decisions as to the credit cards for which you should apply. If you’re confident that you’ll be approved, your score will give a better estimation of terms like your interest rate.

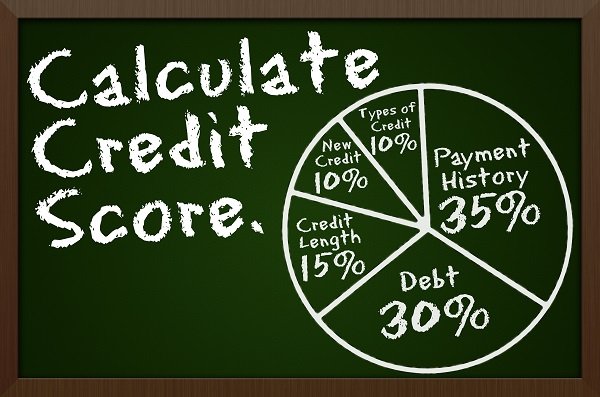

- Determine how actions affect your credit score. You are able to see the effects of specific actions on your credit score. For example, you will see how your score adjusts after opening a new account or paying off a balance.

- Quicker response to changes. With regular monitoring, you’ll be alerted sooner if there is a significant negative change to your score. You can refer to your credit report to determine the cause, then work to recover the difference in points.

- Have the option to qualify for better credit offers. Higher credit scores get better offers. This could be higher limits, better interest rates, or better bonuses or perks. Armed with this knowledge, you can negotiate a lower interest rate or a higher limit with your creditors.

Using Free Services to Check Your Credit Score

There are a number of companies that offer customers free access to their credit scores. Be aware that not all third party sites are free, or even provide accurate scores. Assess the site’s terms before you sign up for anything. A comparison of the more popular choices is shown below.

| Company | Pulls Score Based on Information from… | App | Scoring System |

|---|---|---|---|

| CreditKarma.com | TransUnion Equifax | iOS and Android | VantageScore 3.0 |

| CreditSesame.com | TransUnion | iOS and Android | VantageScore 3.0 |

| FICO Open Access | FICO | No | FICO |

| Mint | Equifax | Yes | VantageScore |

| Bank/Credit Union | FICO | Depends | FICO |

Both CreditKarma.com and CreditSesame.com allow you to view your scores without registering a credit card. In exchange for the free access, they market credit card recommendations to their customers. CreditKarma and CreditSesame update your scores once a month and give access to your credit history. The sites use VantageScore 3.0, an informational score for consumers, instead of the FICO scores lenders use. VantageScore 3.0 provides a fairly accurate estimate for your score based on your credit history. CreditKarma gives you access to a credit score simulator. This allows you to play “what if” with different scenarios to see the impact on your score. CreditSesame provides their customers with $50,000 identity theft insurance for free.

https://financialfree1.wpengine.com/credit-cards/benefits/free-credit-score/

FICO has partnered with certain credit card issuers through the FICO Open Access program. (To date, these include Discover, Bank of America, Barclaycard, American Express, and the Walmart Credit Card.) Users will receive a copy of their FICO score and a statement of major components affecting their score for free. This will accompany their monthly statement.

Your bank or credit union may already offer free credit scores to its customers. You may already be eligible or could be within reach of it. We recommend that you contact them to learn for which services you may qualify.

Paid Services to Monitor Your Credit Score

If you prefer a premium service, you can consider the following companies.

| Company | Regular Cost | Offers | Scoring System |

|---|---|---|---|

| TransUnion | $24.95 per month | TransUnion credit score and credit report Monitoring for all three major credit bureaus Instant alerts and Credit Lock for suspicious activity Access to TransUnion Online Credit Score Simulator | VantageScore 3.0 |

| Equifax | $9.95 per month | Equifax credit score and report Free access to Lock & Alert (separate sign up) | VantageScore 3.0 |

| Experian | $249.99 a year * there's also a free version | Experian FICO 8 score every 30 days Credit monitoring and alerts | VantageScore 3.0 |

| MyFICO.com | $0 (1 bureau) $29.95 per month (3 bureaus, updates every three months) $39.95 (3 bureaus, updates every month) | Monitoring for all three major credit bureaus Tools for re-establishing compromised identity Access up to 28 separate types of FICO scores Threat detection | FICO |

| Fast3CreditScores | $19.99 per month | 14 day free trial Monthly scores from all three credit bureaus via CreditXpert Daily credit monitoring Instant alerts for suspicious activity Support services to help with identity theft | Proprietary (not a FICO score) |

If you are considering these sites, pay attention to the following. For customers currently using the service, TransUnion offers $1 million of identity theft insurance. Equifax, TransUnion, and Experian allow you unlimited monitoring, but MyFICO limits you to once every three months. Despite this, MyFICO still offers daily credit monitoring and credit repair tools if there is a problem.

How Often You Should Check Your Credit Score

Remember our friend Joe from the introduction? He has learned the importance of monitoring his credit score. Now he checks his credit score a couple of times a year to make sure everything is going as it should. You should monitor your credit score regularly. You can do it twice a year, or every month if you prefer. If you’re going to need credit soon for a large purchase, you should probably check it more frequently. For example, you may check your credit score monthly if you’re planning to buy a house or a car. If you monitor your credit score, you can begin to fix any problems you see. Then you can have confidence in your credit score, just like Joe.

I recommend obtaining an official report, you get 3 free a year, but they are not instantaneous. Then check with credit karma

Yeah getting a full report from time to time is a good idea, as bank reporting and credit karma are not complete

Credit Karma is free and has lots of good info – it’s my choice

It’s a good way to monitor the signals to make sure, that nothing fishy is going on with your credit history

Since there are three credit bureaus and you get one free report per year, I heard it is best to request one from each credit bureau every 3-4 months so you always have a very recent report to review.

I would think 3-4 months is a bit overkill, unless you are diligently working on your credit history and need the score for a certain purchase like buying a home