Raise Credit Score Fast with These Moves

Table of Contents

Updated May 31, 2022

Sometimes we make mistakes that affect our credit score. You may have accidentally missed a payment deadline, or opened a new credit card too soon after the last one. The result is that your credit score is no longer perfect. Rebuilding your score takes time. It takes patience to see the efforts to fix your score work out. We’ve looked into ways to save you some time on the wait. If you follow our guide, you should be able to raise your credit score a little faster.

3 Fundamental Steps to Boost Your Credit Score

In order to boost your credit score, you must understand what levers you can use to cause change. There are three main steps needed to improve your score. If you implement these actions, you may be able to raise your credit score a bit faster.

1. Check your credit report and fix any errors

This is the first thing you should do. According to the Federal Trade Commission (FTC), approximately 5% of consumers have significant errors in their credit reports. These errors are bad enough to warrant increased interest rates on financial services or higher insurance costs. A quarter of all reports contain inaccuracies that can have a small effect on your credit score.

Checking your report allows you to review your current credit history. You’ll be able to see what’s going on and identify the issues that affected your credit score. This way, you’ll know what behaviors you can work on to improve your credit score for the long term. You can get a free copy of your credit report in a number of ways; visiting AnnualCreditReport.Com is the fastest method. This website will allow you to request reports from each of the three credit bureaus.

When you check your credit report, you should also review your credit history for errors. You’ll want to make sure that everything listed is correct. Mistakes that are not your fault can still result in credit-related or fiscal penalties. Should you see any inaccuracies, you can contact either the credit bureau or your lender to investigate it further. By law, they must respond within 30 days. If an error is found, it must be removed from your report, and your score must be recalculated.

2. Pay off your credit card balance (keep your utilization ratio low)

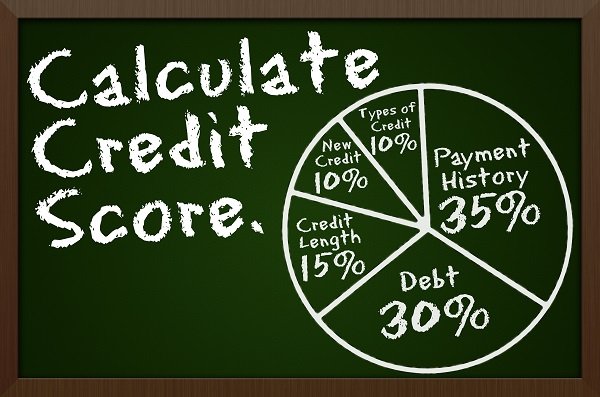

Your utilization ratio is the proportion of revolving debt you owe to the total credit you have available. It has a huge effect on your FICO credit score: a weight of 30% to be exact. A larger debt will have higher utilization than a smaller one. Normally, your credit utilization ratio should be 30% or less. Ideally, you want your utilization to be zero when it is reported to the credit bureaus. This is achieved by paying off your credit card balance completely. (If your balance is too much to handle at one time, consider making micropayments. These are small payments made frequently during the month to keep balances low.) Even if you aren’t able to zero out your balance immediately, you should still aim to have low utilization. Ask your lender if they can raise your credit limit without a hard inquiry (which drops your score even further). Keeping your balance low from as early as the first month rebuilding your score will move your credit score upward.

3. Start paying your bills on time (if you don’t do it already)

Did you know that the single largest influence on your credit score is whether you pay your bills on time? This is also called your payment history. The more months your accounts are delinquent, the worse it affects your score. Missed payments can stay on your credit report for seven years. Improvements in your payment history may not affect your score as quickly as the other two items. At 35% weight, you’ll soon experience positive effects when your on-time payments are reflected in your credit history.

In conjunction with paying your bills on time, call your creditors. Make a plan to pay, and investigate if they will be willing to repeal the late payments from your report.

Be Persistent

Restoring your credit score is not easy, and it cannot be rushed. If you follow our advice, you can shorten the time it takes to raise your credit score. Soon you’ll be on the way to having excellent credit.

If you don’t have any credit history and you want to establish some, then you’ll need to build it safely. Check out the article “Credit History: What it is and How to Establish it Safely.”

My name is Jackson. I have a major problem. My credit score is 470 and I need to raise it to 600 in 30 days. Is this possible?

You are unlikely to raise your credit score from 470 to 600 in 30 days. Improving your credit score takes time and requires consistent efforts and patience. This process is quite slow going and not easy, but the sooner you start dealing with the issues that might have lowered it, the faster your credit score will rise. Follow the 3 fundamental steps described in the above article. They can shorten the time it takes to improve your score. Good luck!

Decided to share my experience with credit score. I added each kid to our oldest card when they each turned 18 and they immediately had a 15 year credit history. Also have a brother on the card too. None of them actually have a card in their possession. Son got his own card a year or so later and was very careful to pay as used so he didn’t forget. Not sure if daughter has applied for her own yet (she’s 20) but expect she’d be very responsible as well. Not all card issuers report authorized users so check yours… Read more »

My wife’s grandparents did this for all their grandkids and also myself shortly before we got married. They had a 20+ years history of ontime payments. Gave a great boost to our credit scores but that lenders look at more than just the number when lending money. Also, when my wife and I applied for a USDA loan for our first home they said we had to be removed as authorized users from that card due to it falsely inflating our credit scores. But I say it’s still a good idea because it does nothing but help your credit score… Read more »

I personally will not be doing this, as I do not want to make it easier for my son to go into crippling debt like the majority of Americans. To each their own of course though.

My daughter is in mine, she doesn’t get the cats though and in the rare occasion I ket her use tube discuss interest and the importance of minimizing debt. Some allow them to be add at 13, some 15, companies vary

My parents did this for me and it definitely saved mine and my husband’s ass a few times. He makes the money but I have the credit score and the long credit history. Also it doesn’t encourage us to go into debt as some people are saying-we needed it to rent an apartment and get our own cell phone plan, our own cable plan and then later to get our car and house

Interesting, I had a credit card with my parents as well just to get 3 cents of at a gas station didn’t know it impacted their credit report or how credit card company treats you.

This is an interesting idea. My concern is…I feel like I’d be taking something away from my daughter if I did this. She may not understand the value of having good credit or the amount of effort and discipline one has to have to establish excellent credit. I will definitely be exposing her to the world of personal finances and help educate her but I don’t know about establishing her credit score for her.

My credit card payment is $30 a month I pay $100 a month will that help my credit score go up?

Is $30 a minimum payment? If so, you really need to work on eliminating the credit card balance as the interest you are paying is extremely high. If your typical balance is $30, then paying $100 won’t help you to increase the credit score.

I had my credit limit lowered after making a 1500 dollar payment. My balances are going down every month because I am not spending yet my score is going down.

If your credit limit was lowered, that means your utilization score can look worse. Sometimes if you don’t use the available credit, they simply close it. You can open a new CC and just make one transaction on it within 18 months and it will stay open.

If I have a credit card with a very low limit, which I never use but I’ve had for a long time, will it impact my credit score poorly if I cancel it? I haven’t used it in many years.

It’s only 1000 limit and I originally got it for small online purchases. That way if it was compromised I still had my regular card and it was a small limit.

If you have no plans whereby your credit score needs to be pulled i.e. mortgage / mortgage refi etc, then just cancel it. It will be a blip, but it will show as activity. Perfectly fine also to just keep the card and throw in a firebox and don’t touch it.

Just make sure its not a card with annual fee. If it is and you don’t want it, cancel it. You will have time to build your credit back up.

I wouldn’t cancel it. Just cut it up. Especially if it’s one of your longest held cards.

If it was me, as long as there’s no fee, I’d ask for a credit line increase and keep it open. It will help the age of ur credit and ur usage. Just buy something small with it once a year or so to keep it active. Closing it seems like more work for a potential downside as opposed to just keeping it open. Just my thoughts

Do not let your cc company close ur card. Generally, if they see no activity for a longer duration they will close ur card. It happened with me. Recently, I tried withh CC company to reopen but they said once its closed they cannot reopen with the same old issue date.. there are several factors that go in to credit score like age, balance,.

If it is one of your older cards, the the average age of cards will go down thus decreasing your score

I would keep it as it is the oldest card. You can ask them for a credit limit increase. You also need to be aware that typically if you don’t use it for 18 months they will close it. So make sure you make small transactions on it.

After paying off the car (whatever) loan make sure you keep the credit card for a long time as there is a “bonus” for longevity. I have 6 that I alternate and pay off for the rewards points(free 1-3% cash back, so a tiny investment on junk you already buy, Lowe’s and Best Buy). I have everything but my car and mortgage paid off, but the cards have carried me after student loans and everything else. I’m at 827 today, and it kills me to still owe, but I keep accelerated paying to keep in great standing so I can buy… Read more »

Yes, keeping large available credit to you (with good age) would improve your credit score. You do have to maintain it, by making small transactions within the 18 months period.

its a rigged game they make you have debt to get a score so you can have more debt…. finance yourself be your own bank and give yourself a score.

The game is rigged, but if you know the rules you can use it to your advantage. Financing yourself means you can use leverage to buy a house for example and end up having less cash flow to invest.

I thought It was better not to have anything on credit, and your score would be high, as you don’t owe anything, but it’s totally the opposite

I wouldn’t say totally opposite, but yes it does payoff to have and use some credit.

I’ve managed to get my credit score up by paying direct debits , I have 2 phone contracts in my name and a few bills in my name also going on the electrol register helps

I’ve never heard of the Electoral register increasing credit score, but then who knows.

The way I did raise my credit score is I got a capital one secure credit card that builds credit used it it small purchase like gas and payed it off every month in full and it raised my credit a lot. At least it worked for me.

For sure, this is a tried and true method especially for newcomers or students who just don’t have a credit history. My first credit card was Capital One with a whooping $300 limit.

I have a mortgage, utility bills, credit card and store card. I pay everything on time and don’t make late payments. Mine is 997. It also makes a difference to credit score if you DONT have anything on credit

Well, the Mortage is a credit, but you do show that you use it responsibly.

Credit karma is free and it really helped me get my score up to a decent level (there are hints on there but you really can see everything) it doesn’t affect your score signing up

Yes if you can avoid the barrage of upgrade offers you can get some useful info there!

I used ClearScore to build mine as it suggests ways to help you

I’ve heard of it, but it doesn’t seem like it works in Canada or USA

Just a reminder:

If your credit score goes up check your insurance rates. I had a nice little boost to my score recently and just got a new policy today on the car for only $62/month full coverage. That’s $40 less a month.

Good looking out. Didn’t even think about this. My score has increased tremendously since I got coverage.

Nice tip as insurance never seems to go down. Even when you car is parked for two years during the pandemic 🙂