How to Get a Late Payment Removed from Your Credit Report

Table of Contents

Updated: July 27, 2022

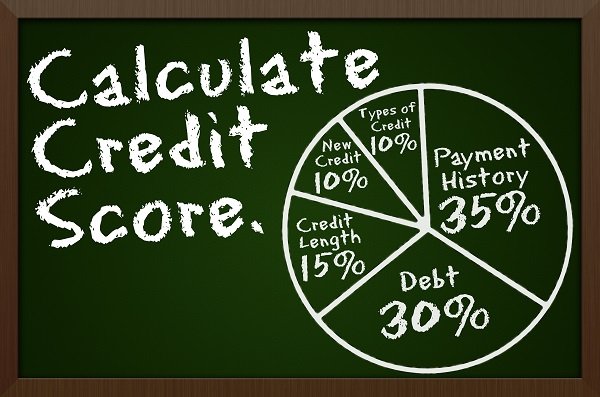

Late payments on your credit report can have a knock-on effect when you next apply for a credit loan. Credit scores are there to show whether or not you can meet your payments on time, so it is only natural that if you have late payments in the past it will bring down your credit score. Whether legitimate or a mistake by your lender, it’s always in your best interest to get a late payment removed from your credit report as soon as possible. Late payments can show up on your credit report for up to seven years so it is vital that you make sure not to get any in the first place.

How Late Payments Appear in Credit Reports

There are two ways a late payment will show in credit reports – accurately or by mistake.

- If you have actually made a late payment it will prove difficult to have it removed from your credit report. Getting it removed will be a time-consuming process and it may not even be possible at all.

- If your credit report is showing a late payment by mistake, it is usually down to your lender or the credit bureau, they may have just forgotten to add the payment to your report. If this is the case you should dispute the error immediately. It is relatively easy to have the late payment removed and your credit score won’t be affected.

3 Ways to Remove Late Payments from Your Credit Report

It may be difficult and take some time, but there is always a chance to get a legitimate late payment removed.

Ask

The first option is simply to ask. Writing a goodwill letter or calling your lender and giving an honest explanation for your late payment, for example, hospitalization or family bereavement. If it was a once-off late payment and you have since been paying your bills on time, this will certainly help your case. Remember in your letter or over the phone, you are dealing with another human being so try to remain calm and explain your reason for the late payment in a rational manner.

Make an Offer

Secondly, you can make an offer to your lender. Lenders always prefer you to sign up for automatic payments for example, but it isn’t always an option for you at the time. However, if you can offer to sign up for automatic payments, perhaps the lender will be able to remove your late payment from your credit report in return. Automatic payments ensure that the lender will receive their money on time and without any hassle for them. The lender may suggest another way for you to have your late payment removed if you are in the position to agree to it.

Get Professional Help

Lastly, get professional help. If the first two options don’t work for you, and you still have your late payments on your credit report, it may be worth looking into getting an attorney. This may be a costly process but they should be able to review the position and there may be additional options available to you under federal or state laws.

Be Persistent

Don’t think that once you have a late payment it is impossible to remove it or rebuild your credit score. Make sure you go down all possible avenues to have your late payment removed, and don’t give up after the first go. Be persistent. If all else fails and you don’t succeed, you need to start rebuilding your credit score. You can rebuild your score by ensuring you have no more late payments in the future, so get them in on time. If you can’t set up automatic payments for the full amount, try setting them up for the minimum payment required.

Yes, ask is the best option to start with. We called our creditors after we suffered a tornado and everything was late that month, they removed the late reporting and some even refunded the late fee

Everything in life is negotiable, including the late payment on your credit report

I’ve had one removed because my son was born early, just called them

Yeah there are people on the other side of the line. Sometimes all it takes is just to ask for the notice to be removed

If it’s not a consistent occurrence, most companies have no problem removing the charge if you call or email

Agreed, taking proactive stance on monitoring your credit report and asking the companies to remove it

I had neglected to make a payment to a store cc mainly because i forgot i used it since i rarely use it. I called them and explained the situation. They refunded the late fee and got rid of the negative credit bureau reporting. I think to call them and ask them nicely is a good option. If you have an excuse like moving or rarely using the account or something, let them know that.

Yeah I think, if you are not doing it repeatedly and don’t dodge their calls, but call them back they will be accommodating in removing the late payment from your credit report

One more way to get late payment removed. You can challenge the claim with each credit bureau claiming it is not your debt. The company that put it on your credit report then has to prove it is yours within a certain time period and if they do not reply, it gets removed. Generally speaking, companies won’t waste their time to prove a debt that is paid off.

Yes, this is not the most ethical way but credit bureaus aren’t exactly ethical either.

Can be used as a last resort. I think calling first is a good option. I agree that credit bureaus are not that ethical, especially the ones that make it look like you are buying your credit score report, when instead you are signing up for a monthly subscription