What and How Many Credit Cards Should I Have: Full Guide

Last Updated: May 3, 2023

Table of Contents

- How Do You Win the Card Game?

- This is NOT a Game

- If You Are Not Ready, Improve Your Financial Health First

- Choosing the Optimal Number of Credit Cards for a Healthy Financial Profile

- What Is the Number 1 Credit Card?

- Should I Have a Backup Credit Card?

- Card #3 Is a Credit Card for Your Special Needs

- When Should I Balance Transfer?

- Choose the Right Cards for You

Win the Credit Card Game

Credit Cards are necessary, like your cell phone or a driver’s license in 2023. They are powerful tools that can destroy your finances when used incorrectly. Our goal is the opposite – to win the Credit Card game and to use credit cards for our benefit.

Consumers should curate a selection of cards that provide them with the best benefits for their personal needs. There are cards for different purposes: travel rewards, cash back, balance transfers, and secured cards. Some cards are pretty basic, while others promise you the world with the swipe of your hand.

This is NOT a Game

Every time you apply for or use a Credit Card, your Credit History gets impacted. Due to the high APR on credit cards, it is very easy to fall into a financial trap when you are just trying to keep up with monthly payments.

We recommend this guide for those with strong financial health. Indicators of strong financial health include a minimum credit score of 720 and fully paying off your balances every month. Use this guide only if you are 100% confident that you can pay your Credit Card balance in full each month. If you don’t pay off your credit card debt even for one month – all of the potential savings discussed in this guide will be erased.

If You Are Not Ready, Improve Your Financial Health First

Focus on reducing your debt. For help figuring out your credit card finances, visit our calculators. Our credit card payoff calculator explains how long it’ll take, and how much it’ll cost to pay off your card. The credit card payment calculator shows your payments if you paid off your credit card debt in a specified time.

Once you get control of your debt, you can repair your credit. Consider applying for a secured credit card. The security comes from the card issuer shifting the credit risk onto the customer by holding a deposit for the card. Your deposit is returned when the card is converted to an unsecured one. Meanwhile, lenders report your credit behaviour to the credit card bureaus. This builds your credit card history.

Choosing the Optimal Number of Credit Cards for a Healthy Financial Profile

You probably have questions, like what kind of cards you should hold; and how many credit cards you should keep. We recommend that you hold three cards. Three is the number at which most people can manage without sacrificing their financial health. Once you become more proficient, with the Credit Cards benefits, you can add more cards for special transactions.

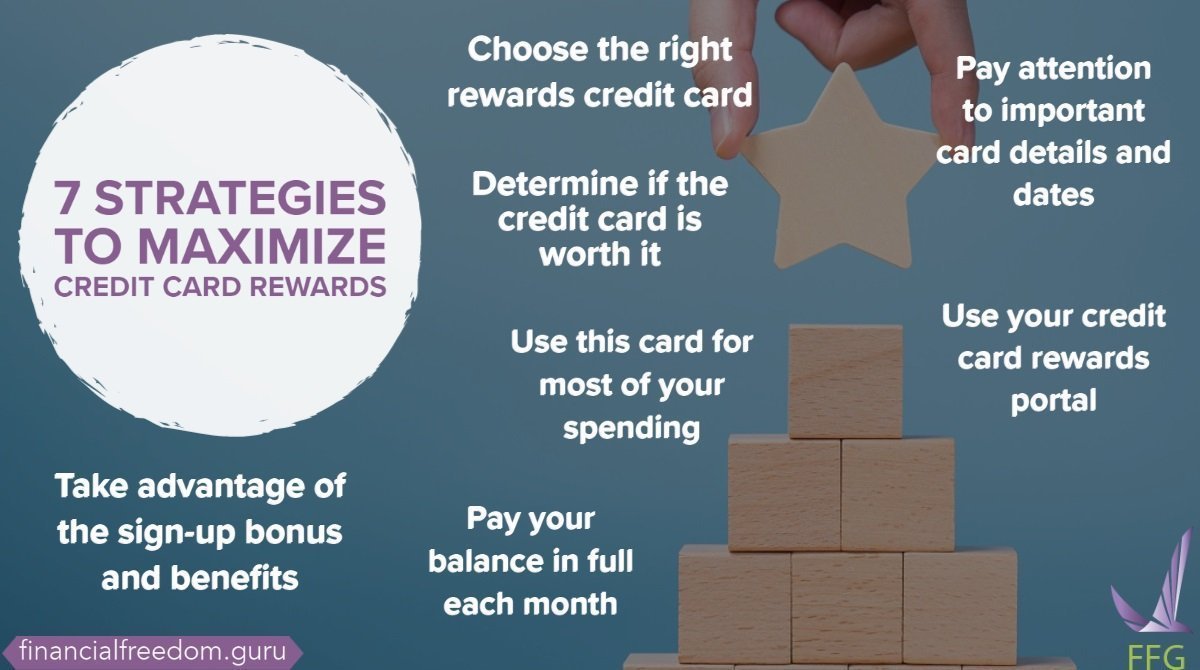

Card #1 Is Your Primary Credit Card

This is the card that you would use most frequently. We recommend selecting a rewards card guided by your current spending habits and ultimate goals. The more money you spend on your credit card, the more benefits you will earn. Many credit cards offer annual bonuses for hitting specific reward thresholds. That is why once you select the best card for yourself, you must put most of your transactions on that card to maximize the rewards.

!!! Warning: Do not spend beyond what you can afford to chase rewards. You’ll end up accumulating finance charges and debt that erode your benefits.

Where you spend your money is important. If you eat out at restaurants frequently, your optimum credit card should offer perks for dining out. Review your bank and credit card statements over the last few months. You’ll want to see the various types of merchants you shop from and the frequency and patterns.

Types of Rewards Credit Cards

After seeing the patterns in your spending habits, you should decide what rewards you want to earn.

- Retail or Store-Branded. If you tend to favour a particular brand, you can consider a card tied to their retail store(s). It’s usually linked to an immediate discount (for signing up), and recurring exclusive discounts for future store purchases. There may be other benefits, like free shipping when using your card.

- Co-Branded Airline and Other Travel Cards. You may prefer to travel with a particular airline or stay at a specific hotel chain. Your card will reward you with bonus points and special perks when booking the flight. The best benefits are gained by booking through the issuer’s travel website using your card. You can earn more points for purchases made through the brand. In return, you may receive special bonuses, like an extra night, or free Wi-Fi.

- Transferable Points Travel Cards. If you are not loyal to a specific brand, consider investing in a card with a transferable points program. Your points are exchanged for benefits offered by your card’s travel partners. You can choose the best hotel and airline to use when booking your travel, instead of being limited to one brand.

- Non-Affiliated, Fixed Value Point Cards. If none of the previous card categories matches your habits, consider a card that offers fixed-value points. You’ll earn points which can be redeemed for tangible goods, cash, or statement credits.

Card #2 Is Your Backup Credit Card

You need a backup card if you can’t use your primary card. You can lose your primary card or it can get locked for fraud activity. While you wait for a new card to arrive in the mail, you will still have the ability to pay with your backup Card.

This is not your primary card; you need a no-annual-fee credit card. Annual fees can range from $25 to $500 per year. If you don’t use your secondary card often enough, you may question if the card and fee are worth it. This concern is eliminated with a no-annual-fee card.

Reasons for Getting a Backup Card

Here are some other valid reasons for investing in a secondary card.

- Something happened to your primary card. Your primary card may have been lost, stolen or damaged. Although your issuer will send a replacement in a few days, you may need to purchase before. It could be a charge you can’t delay until the replacement arrives. Perhaps a bill became due and you don’t want late charges.

- You can improve your credit score. Even if you don’t use the card that often, your card behaviour will be reported to the credit bureaus. Having more than one long-term card with good credit behaviour will improve your credit score. This is especially true if you have good habits like paying it off monthly. Lenders use your credit score to determine what kind of consumer risk you will be. Their assessment determines if, and under what terms, you will get a loan. A higher credit score will make it easier to qualify for other loans in the future, like a mortgage.

- You can improve your utilization. Utilization is the ratio of revolving credit you use to your total amount. This is worth 30% of your credit score. The Fair Isaacs Company (FICO) Score model used by most lenders considers your overall utilization and utilization by card. Lenders prefer if you have 30% or less utilization on each card. When you’re nearing that limit, you can switch to paying for things with your secondary card.

Card #3 Is a Credit Card for Your Special Needs

Your third credit card should be specifically for special purchases. You should not apply for a new card without considering your financial situation. It would benefit you to understand when it’s a good idea to get card #3. Your third card should come from one of your current issuers (see the bullet point below, “Build faster rewards”). There should be no more than two special purchase credit cards (the third and possibly fourth card) in your wallet. The implications to your credit and financial health make this due diligence critical.

When Is It a Good Idea to Get Credit Card #3?

To answer this question, you should think about the following:

- Maximizing your Cashback. The primary reason to get a specialty card is if it gives you a bigger effective cash back than your primary Credit Card. For example, if your primary credit card gives you back 2%, but you can get 4% on gas back with a specialty credit card – this is a good reason to consider it.

- Diversifying rewards. When analyzing your spending habits, you may have had more than one leading spending category. Your first two cards will provide rewards towards the two largest groups, but not necessarily the other top ones. Perhaps you may already understand the benefits of having a diverse set of rewards. Your third card can fill this rewards gap. You should maximize the perks you receive from things you were going to buy anyway. Imagine you’re looking for a third card to match the cash back and no annual fee cards in your wallet. You’re interested in an airline credit card. This new card will have benefits your other two cards may not offer. You may now have access to free airline tickets and travel insurance that you didn’t have before.

- Build faster rewards. If your cards come from the same issuer, you may be able to combine the rewards from both accounts into one pool. American Express users are allowed to pool rewards into one account. Citi offers the same benefit to their customers. Chase’s Ultimate Rewards lets you transfer your points into another household member’s account. Doing this allows you to use your points if you or a household member cancel a card. This same program permits conversion from cash-back points to Ultimate Rewards points of higher value.

Credit History Implications

- How long have you had your last card? Your last card’s effect can take 6 months to a year to be seen on your credit report. Every time you apply for new credit, your credit score drops. Applying for multiple cards quickly will cause major damage to your score. If it has been less than a year since you last applied for credit, wait until the 12-month anniversary of your current card.

- Can you manage to add this additional card to your wallet? Answer this question requires honesty about your financial situation and past credit card usage. Managing three cards is not that easy. You have three bills to pay, three due dates to remember, and three credit limits to track. If you have low utilization and pay your balance in full every month, you’re a strong candidate for card #3. However, you shouldn’t get a third card if you’ve maxed out your other two cards. Instead, you should work to pay down your credit card balance while developing better spending habits.

When to Consider a Balance Transfer Card as a Specialty Card?

If you plan a big purchase, such as a wedding ring or a second car, applying for a zero balance transfer card might be tempting. Consumers who use these cards need to understand the risks associated with them.

A balance transfer card lets you transfer high-interest debt onto a new, lower APR card. The balance transfer process usually costs $5 or $10 or 3-5% of your balance. This means it is not 0% as you still incur debt expense. It applies a low-interest rate to your account for at least 6 months (as required). If you are going for a balance transfer card you should always aim for the longest promotional period for which you can qualify.

Things to Keep in Mind When Choosing a Balance Transfer Card

When choosing a balance transfer card, you should consider a few things. You must pay off the debt before the promotional time expires, as your APR will rise to the regular rate. Be aware of your introductory, regular, and penalty interest rates. You should not assume your promotion expires on your due date; double-check this with your card issuer.

When paying off your debt, do not make new purchases. There are two reasons for this. Balance transfer cards allocate debts to multiple accounts with different APRs. Your 0% APR may not apply to new purchases. Unless you can pay off your balance within the month, you’ll pay the full APR on month-to-month balances. According to the Credit CARD Act (2009), your payment is applied in a specific order. The minimum payment is applied, and then the remaining funds are put toward your accounts in order of descending APR. In other words, instead of paying off your low-interest debt, you’re paying off new purchases at a higher APR. This will result in a nasty, expensive shock at the end of your promotional period. At this time, your regular APR will be applied to the balance of your high debt balance.

Balance transfer cards have consequential benefits and drawbacks, and it’s best if you are familiar with them. The advantages include the lower APR, better terms (than your last card), debt consolidation, and other perks. Your disadvantages include the inevitable high APR, the balance transfer fee, and the high credit score you need to qualify.

Choose the Right Cards for You

With the accessibility of credit cards, it can be overwhelming to build a good credit card portfolio. Making decisions about the types and quantity to own is an important part of a strong financial strategy. A potent instrument like a credit card should be carefully selected based on one’s overall fiscal situation.

Our research recommends that the average consumer in good financial health has three cards. At three cards, consumers should be able to maintain a good credit score and pay off balances each month. If your credit score isn’t good or you have high debt, your priority should not be credit cards. Instead, you should focus on paying down debt and improving your credit score. Use our calculators to help crunch the numbers. If you insist on applying for a credit card, a secured credit card is the best option to pursue.

If you’re ready to build your credit card portfolio, use the following links to research different types of cards. For those of you with a good credit score, and looking for your primary card, consider these rewards credit cards. We also invite you to look up some no annual fee credit cards as either a primary or a backup card. For the seasoned credit card user managing their accounts well, look at these balance transfer credit cards.

How many credit cards do you own? Do you have a primary, backup, and a special credit card? What types of credit cards do you prefer? Share your opinions on the ideal number of credit cards.

I have two credit cards:

1 – I keep rolling, maybe 100.00 to 200.00 a month. I pay it off every month.

2 – is only for emergency.

For me, it’s the ideal number of credit cards.

Yeah keeping it simple is a good tactic with the credit cards. Build your credit while staying disciplined!

I’ve had only 1 card for many many years. I use it for every bill/purchase I can, and I pay the entire bill monthly. My credit score hovers around 820’s. So, in my opinion and experience, 1 credit card is exactly enough.

Yeah, that is a good credit card tactic. You could probably squeeze a bit more if you got a specialty credit card for a specific retailer. Like I have Amazon credit card and it gives way higher redemption at amazon than my primary credit card.

I have always had 2 credit cards. Now I think of taking one more card for my special needs. Thanks for the article.

If you mastered 2 credit cards, you can probably scale your skills and get even higher effective cashback rate!

I have 4 cards – 1 MasterCard, 1 Visa, 1 AmericanExpress and 1 Discover. I prefer to have at least 1 of each of the major credit cards but most retailers take a variety unlike years ago stores were very exclusive and only took 1 or 2 brands.

That’s nice, I actually never looked at cards I have I think most of them are Visas never put a thought into having a different issuer.

From the point of view of credit history, it’s not the number of credit cards that matters, but the utilization. If you keep debt below 30% of overall available credit, it’s ok to have as many cards as you wish.

Well also if you have more credit cards, you would have more total debt available to you, so your utilization score would improve if you don’t use those credit cards.

I just keep 3 credit cards.

Same here, I have a primary credit card that gives the best points everywhere, I have amazon as it gives nice cashback there and one simple just as a backup.

While you are building your credit, and FICO score you do not need to apply for a credit card without it being hard hit on your your credit report. Because if you are not approved other creditors do not know your credit limit and hopefully your current credit card is is maintained below 30% to maintain a good FICO score.

It’s not about being approved or not, if you are applying for a lot of credit cards at the same time it looks like you have financial trouble and trying to get leverage.

I just got my Capital One card about a month ago and my credit score’s just jumped up two days ago 19 points

I have this card, it the best one to have…no annual fees. No hidden fees. It’s a great card

That was my first card when I was a student $300 limit as well