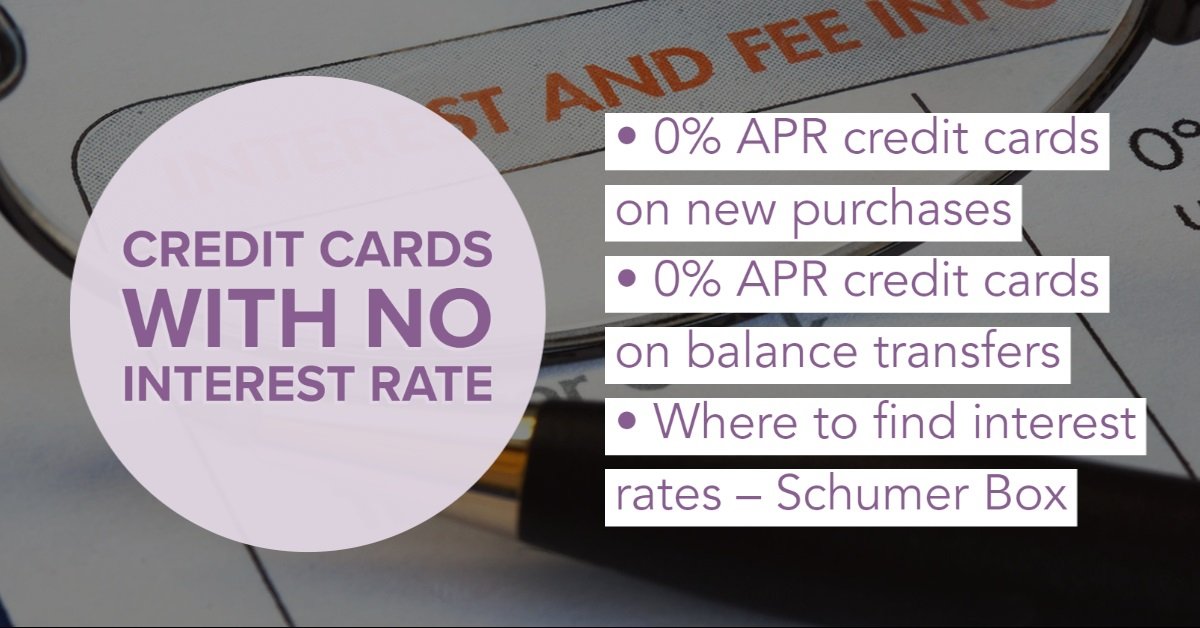

Choosing 0% APR Credit Cards Wisely: 4 Factors to Consider Before Applying

0% APR credit cards are powerful tools to help reduce credit card debt. They allow you to pay off the principal of the debt without accruing interest over a given period of time. This 0% APR offer may apply to new purchases, past balance transfers, or both. If you are looking for 0% APR credit Read more